Why Timely Financial Information Matters

(And how to work backwards from your audit date)…

Timely financial information is not just a compliance issue. It affects people.

Across community organisations, clubs, charities and incorporated associations, delays in financial reporting often lead to:

Frustrated committee members

Delayed Annual General Meetings (AGMs)

Rushed decisions

Burnout of volunteer treasurers

Poor succession when roles change hands

Both the Queensland Audit Office and the Australian Taxation Office consistently emphasise that timely information improves accountability, decision-making, and trust. But there is also a very real human cost when information arrives late.

The human reality behind “late accounts”

In practice, we often see the same pattern:

A treasurer resigns mid-year

Records are not finalised

BAS lodgements are delayed

The auditor is contacted “urgently”

The AGM date slips… sometimes by months

By that point, volunteers feel stressed, committees lose confidence, and new office-bearers inherit problems they didn’t create.

Timely information isn’t about perfection — it’s about momentum.

Why timely information matters (beyond compliance)

Timely financial information allows committees to:

Understand cash flow before problems arise

Meet AGM deadlines under the rules

Make informed decisions with confidence

Support smooth leadership transitions

Avoid last-minute pressure on volunteers

As the Queensland Audit Office notes, information that arrives too late often loses much of its value. The ATO makes the same point — decisions made on outdated information increase risk, even if the numbers are eventually correct.

A practical way to plan: work backwards from your audit

Instead of asking “When can we do the audit?”, a better question is:

“When do we want our AGM, and what needs to happen before that?”

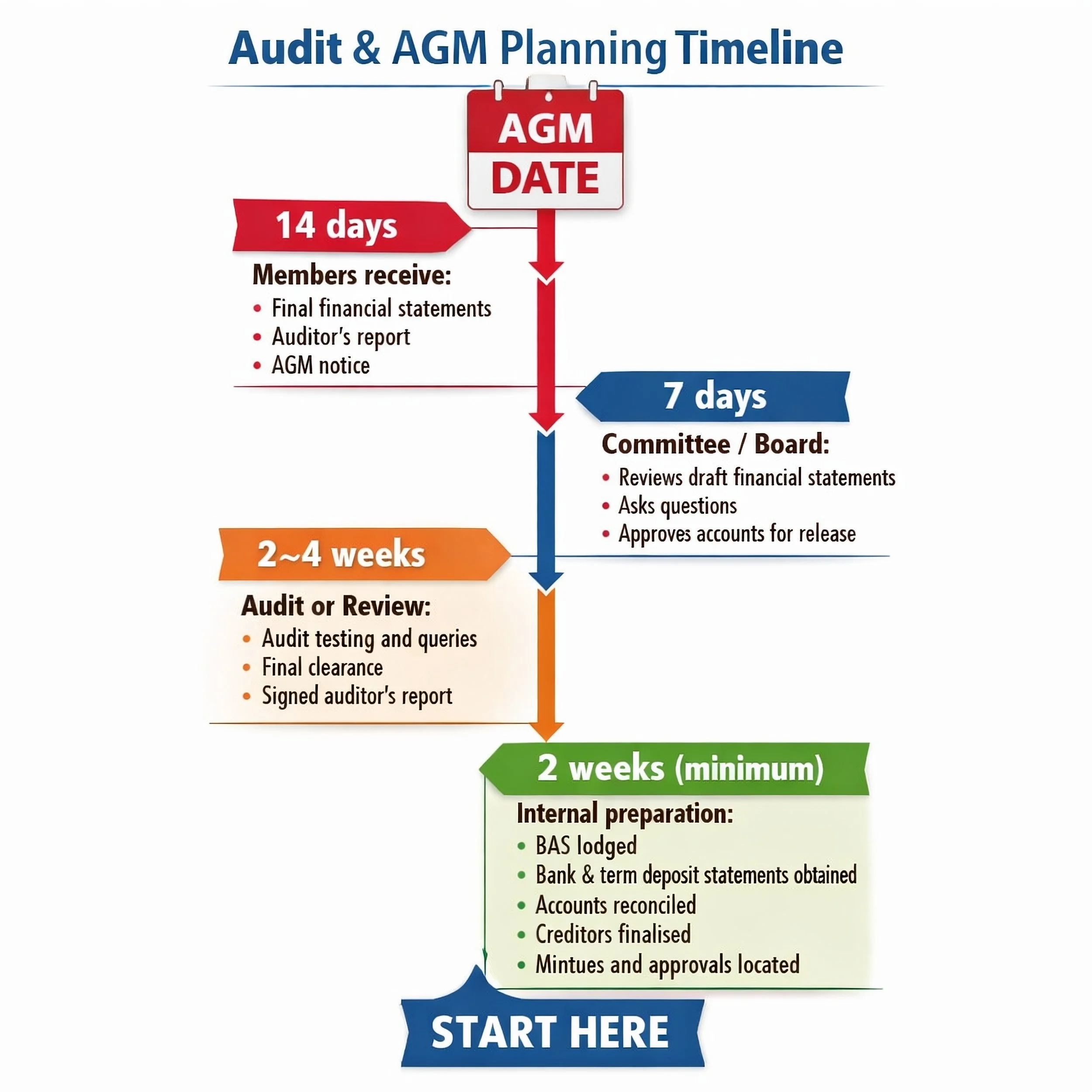

Here is a simple, realistic timeline that works for most organisations.

Step 1: AGM notice to members – 14 days

Most constitutions and rules require:

Financial statements to be circulated

At least 14 days’ notice before the AGM

This means the accounts must already be final.

Step 2: Committee approval – 7 days

Before release to members, the committee needs time to:

Review the draft financial statements

Ask questions

Approve them for issue to the members

This is often underestimated.

Step 3: Audit or review – 2 to 4 weeks

This is where auditors usually fit into the timeline:

Testing

Queries

Final clearance

Signed reports

This stage runs smoothly only if records are ready.

Step 4: Internal preparation – at least 2 weeks

This is the most critical step, and the most overlooked.

Before the auditor or reviewer starts, organisations should allow time to:

Lodge outstanding BAS

Reconcile bank accounts and ensure all bank statements, including term deposits, are available

Close creditors and accounts payable

Finalise payroll, super, and grant acquittals

Locate minutes and key approvals

Without this step, everything else slows down

This is the most important step — and the one most affected by people, not processes.

In many organisations, financial information is spread across volunteers, employees, and sometimes an external bookkeeper. Emails are missed, assumptions are made, and responsibilities are not always clear — particularly when roles have changed during the year.

It is common for a management committee member (often a volunteer treasurer or secretary) to be the main point of contact with the auditor or reviewer. That person is then trying to coordinate information from:

staff or volunteers,

an internal or external bookkeeper,

past office-bearers,

and bank or software providers.

When information is incomplete, communication can quickly become confused:

Was the BAS lodged by the bookkeeper or not?

Who was meant to download the bank or term deposit statements?

Why is the auditor asking for something we thought had already been done?

From the committee’s perspective, it can feel like the auditor or reviewer is “blocking progress”. From the auditor’s perspective, they are required to work only with complete and verifiable information.

Without this step, everything else slows down.

In practice, the most common causes of delay in audits and reviews are outstanding Business Activity Statements (BAS), missing bank statements, and term deposit statements that have not been obtained or reconciled.

As delays grow, the volunteer who is liaising with the auditor often ends up carrying the frustration back to the board or management committee. Difficult messages have to be delivered, timelines move, and confidence drops — even though no one has done anything wrong.

Clear preparation, clear roles, and a short buffer of time before the audit starts can prevent this cycle and make the process calmer for everyone involved.

Why delays compound over time

When information is late:

Committees hesitate to make decisions

AGMs are postponed

New treasurers inherit unresolved issues

Institutional knowledge is lost

Volunteers disengage

Over time, this creates a cycle where every year feels harder than the last.

A simple rule of thumb

If you want a smooth AGM:

Plan for at least 6–8 weeks before your AGM date.

Not for the audit alone — but for the entire process.

Timely information doesn’t just help auditors do their job.

It protects volunteers, supports good governance, and makes community organisations sustainable.

Audit and AGM planning timeline infographic showing the steps and timeframes required before an Annual General Meeting, including internal preparation, audit or review, board approval, and member notice periods